The Future of Investing:

Explore Online Mutual Funds

What are Mutual Funds?

A mutual fund is an investment vehicle that pools money from several investors to invest in a mix of assets like stocks, bonds, government securities, and even gold. Mutual funds allow investors to achieve portfolio diversification and professional management, with returns and risks based on the performance of the fund’s investments.

Mutual funds are investment vehicles that allow individuals to pool their money together to invest in a diversified portfolio of assets, such as stocks, bonds, or other securities.

Advantages of Mutual Funds

Mutual funds offer several advantages for investors looking to build wealth and manage their investments effectively.

Professional Management

Mutual funds are managed by experienced professionals who make investment decisions based on thorough research and analysis.

Liquidity

Investors can easily buy or sell mutual fund shares at the current net asset value (NAV) on any business day, providing flexibility.

Diversification

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Ways to Invest in Mutual Funds

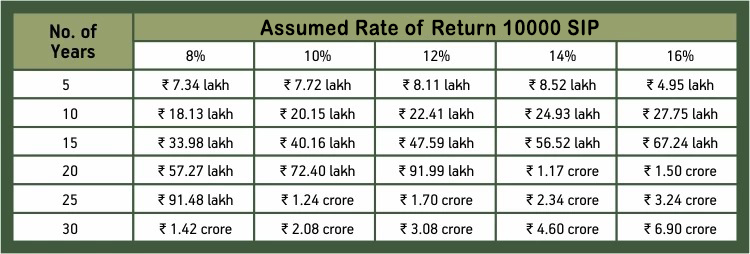

SIP (Systematic Investment Plan)

We believe that financial security is a journey, not a destination. With our Systematic Investment Plan (SIP) offerings, we make that journey accessible to everyone. Our SIP solutions are designed to help you build wealth steadily, offering a disciplined way to invest in mutual funds, allowing you to grow your money over time with small, regular contributions.

With expert financial advisors and personalized investment strategies, we ensure that your investments are aligned with your long-term financial goals. Whether you are a first-time investor or looking to diversify your portfolio.

Lumpsum

A lumpsum investment refers to investing a large amount of money in one go, rather than spreading it out over time through smaller, regular investments (like in a Systematic Investment Plan, or SIP). It is ideal for investors who have a substantial sum of money and want to take advantage of market opportunities at a specific time.

The key benefits of lumpsum investments include potential for higher returns if invested during a market low, immediate exposure to market growth, and simplicity in managing the investment. However, it also carries higher risk, as investing a large sum at once can lead to losses if the market declines soon after the investment is made.

Types of Mutual Funds

Top 12 Equity Mutual Funds

HDFC Mutual Fund

ICICI Prudential Mutual Fund

Birla Sun Life

Kotak Mahindra MF

Mirae Asset Large Cap Fund

Nippon India Small Cap Fund

Axis Mutual Fund

Canara Robeco Bluechip Equity Fund

Motilal Oswal Midcap Fund

Parag Parikh Flexi Cap Fund

SBI Mutual Fund

DSP Mutual Fund

Types of Mutual Funds

Equity Mutual Funds

Equity funds invest a majority of their assets in stocks. These funds are classified into different categories based on the market cap of the stocks they invest in.

Large-Cap Funds >

These funds invest at least 80% of their assets in the top 100 companies by market capitalization.

Mid-Cap Funds >

These funds invest at least 65% of their assets in the next 150 (101st to 250th) companies ranked by market capitalization.

Small-Cap funds >

Such funds invest at least 65% of their assets in companies ranked 251 and above by market capitalization.

Multi-Cap Funds >

These funds invest at least 25% of their assets in each of the large, mid, and small-cap stocks.